Revamping the Pension Portal with users every step of the way

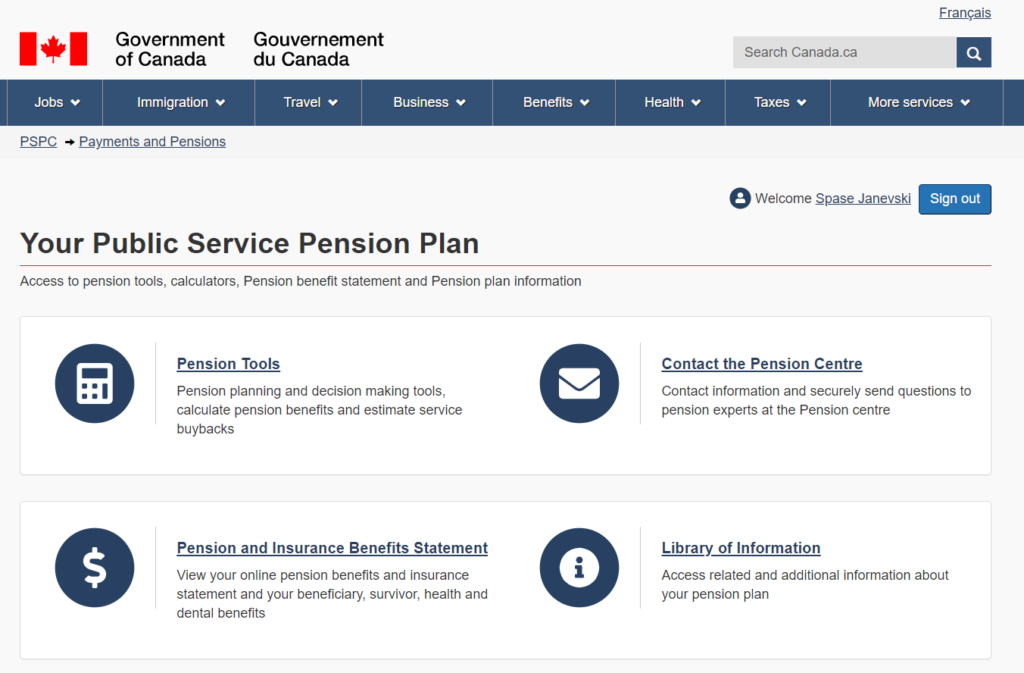

Our Human-Centred Design Office (HDO) is helping the Government of Canada’s pension program redesign its pension portal – a compensation web application used by current employees of the public service, the RCMP and the Canadian Armed Forces. Pension issues can be complex but this doesn’t mean our pension portal needs to be.

Learn more about the process HDO followed when working with the Pension team to help them design a user-friendly portal that would enable employees to make important life decisions.

Just because pension issues can be complex, doesn’t mean our pension portal needs to be.

The steps we take together

1. Understand the current state

Current state

The first thing our Human-Centred Design Office and the Pension team did was put together a multidisciplinary team including experts in pension, user experience, design, accessibility, technology and more.

To understand the current state of the pension portal, we analysed its interface and usability. We discovered that employees had to deal with two different user interfaces, making the experience not user friendly or inviting to use.

2. Explore the business context

Business context

Next, the HDO and Pension team did a deeper dive into the larger business context, exploring previous research, business requirements, policies and important technical requirements:

- Pension Portal Test Environment

- Pension Related Postings on social media (Reddit, Facebook)

- Encouraging Retirement Planning through Behavioral insights

- Portal Technical Architecture Specifications

- Public Service Superannuation Act

- Report on Public Sector Pension Plans as of March 31, 2018

- Results of the 2019 Public Service Pension and Benefit Plans Member Survey

- Pension Web Renewal Business Requirement

3. Conduct user interviews

User interviews

Next, we talked to the users – about 50 of them from across government. And we didn’t just talk, we watched and listened during hour-long sessions where each user interacted with the current live pension portal. They told us what they were experiencing, the good, and the not so good. And through close observation, we learned about user behaviours, needs, preferences and expectations.

| Government Department | % of Users Interviewed |

|---|---|

| Pension Strategic Planning and Integrity Directorate (PSPID) | 25% |

| Pension System Support (PSS) | 13% |

| Pension Program Management (PPM) | 16% |

| Shared Services Canada (SSC) | 16% |

| Employment and Social Development Canada (ESDC) | 4% |

| Real Property Service (RPS) | 3% |

| Environment and Climate Change Canada (ECCC) | 3% |

| Canadian Armed Forces (CAF) | 9% |

| Royal Canadian Mounted Police (RCMP) | 9% |

| Parks Canada (PC) | 3% |

| Public Services and Procurement Canada (PSPC) | 5% |

4. Develop user personas

User personas

The information we gathered was illuminating and invaluable. It allowed us to create “personas” – different types of users of the pension portal.

The personas – 3 typical users of the pension portal

Hanna

The Career Builder

Users in the early stages of the career who are focused on finding the right growth opportunity.

Meera

The Career Changer

Users who are going through a life event and want to optimize their pension to improve their retirement prospect.

François

The Pension Planner

Users in the late stages of the career who have started thinking about life after retirement.

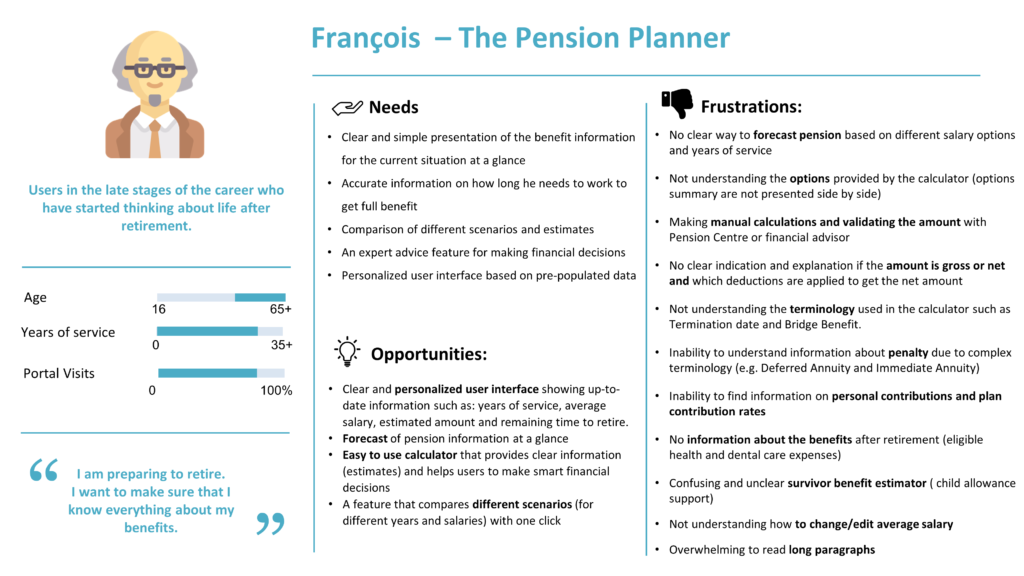

Meet François, who is getting closer to retirement

Long Description: François-The Pension Planner

This is the persona profile for François, the Pension Planner. François is in the late stages of his career and has started thinking about life after retirement.

- François is nearing 50 years old. He has about 30 years of experience and has visited the pension portal about 80%.

- François states: “I am preparing to retire. I want to make sure that I know everything about my benefits”.

From the pension portal François needs:

- Clear and simple presentation of the benefit information for his current situation at a glance.

- Accurate information on how long he needs to work to get the full benefit.

- Comparison of the different scenarios and estimates.

- An expert advice feature for making financial decisions.

- Personalized user interface based on pre-populated data.

François is having these frustrations with the current pension portfolio:

- No way to forecast pension based on different salary options and years of service.

- Not understanding the options provided by the calculator (options summary are not presented side by side).

- Making manual calculations and validating the amount with the Pension Centre or financial advisor.

- No clear indication and explanation if the amount is gross or net and which deductions are applied to get the net amount.

- Not understanding the terminology used in the calculator such as Termination Date and Bridge Benefit.

- Inability to understand information about penalty due to complex terminology (e.g. Deferred Annuity and Immediate Annuity).

- Inability to find information on personal contributions and plan contribution rates.

- No information about the benefits after retirement (eligible health and dental care expenses).

- Confusing and unclear survivor benefit estimator (child allowance support).

- Not understanding how to change or edit average salary.

- Overwhelming to read long paragraphs.

Opportunities for improving the pension portal to meet François’ needs include:

- Clear and personalized user interface showing up-to-date information such as years of service, average salary, estimated amount and remaining time to retire.

- Forecast of pension information at a glance.

- Easy to use calculator that provides clear information (estimates) and helps users make smart financial decisions.

- A feature that compares different scenarios (for different years and salaries) with one click.

5. Create user journey maps

Journey maps

Next we created “journey maps” for each user, capturing their experiences, pain points along the way and opportunities for improvement.

See François’s journey map as he uses the pension portal to plan for retirement.

Meet François, who is getting closer to retirement

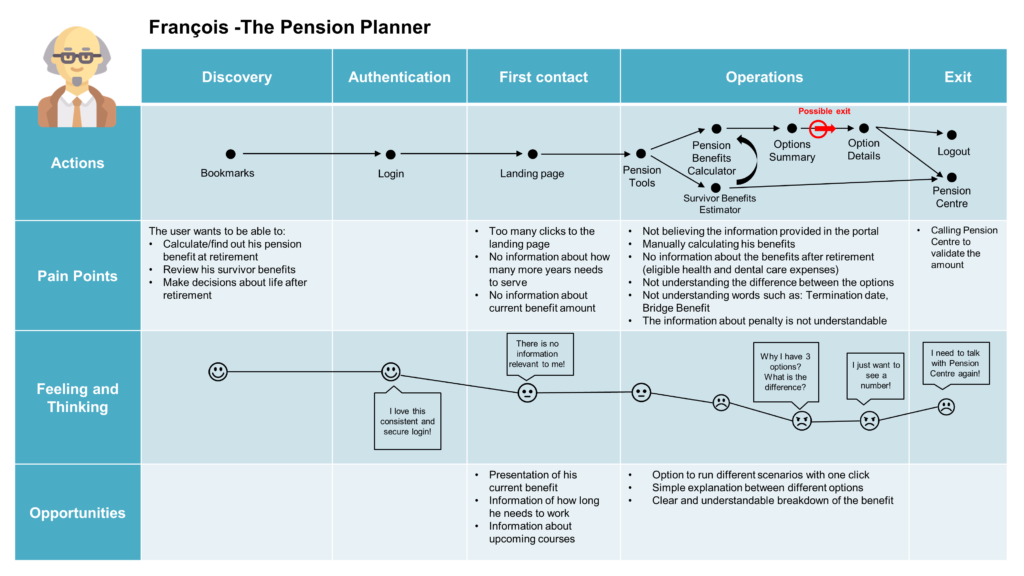

Long Description: François-The Pension Planner journey map

This is the journey map for François, the pension planner, as he uses the pension portal. The journey map captures François’ actions, his pain points, what he is feeling and thinking, and opportunities for each stage of his journey: discovery, authentication, first contact, operations and exit.

In the discovery phase of François’ journey:

- Action: François creates a bookmark.

- Pain points: François wants to be able to:

- Calculate or find out his pension benefit at retirement

- Review his survivor benefits

- Make decisions about life after retirement

- Feeling and thinking: François is happy

- Opportunities: None

In the authentication phase of François’ journey:

- Action: François logs in

- Pain points: None

- Feeling and thinking: François is happy and thinks, “I love this consistent and secure login!”

- Opportunities: None

In the first contact phase of François’ journey:

- Action: François goes to the landing page.

- Pain points:

- Too many clicks to the landing page.

- No information about how many more years he needs to serve.

- No information about current benefit amount.

- Feeling and thinking: François is neutral and thinks, “There is no information relevant to me!”

- Opportunities:

- Presentation of François’ current benefit

- Information on how long he needs to work

- Information about upcoming courses

In the operations phase of François’ journey:

- Action: François uses the pension tools. He uses the Pensions Benefits Calculator and the Survivor Benefits Estimator. He receives an Options Summary. He possibly exits the pension portal before looking at the Option Details.

- Pain Points:

- Not believing the information provided in the portal.

- Manually calculating his benefits.

- No information about the benefits after retirement (eligible health and dental care expenses).

- Not understanding the difference between the options.

- Not understanding words such as: Termination Date, Bridge Benefit.

- The information about penalty is not understandable.

- Feeling and thinking: François starts out neutral but becomes increasingly unhappy. François thinks, “Why do I have three options? What is the difference?” and “I just want to see a number!”

- Opportunities:

- Option to run different scenarios with one click.

- Simple explanation between different options.

- Clear and understandable breakdown of the benefit.

In the final exit phase of François’s journey:

- Action: François either logs out of the pension portal or contacts the Pension Centre.

- Pain Points: Having to call the Pension Centre to validate the amount.

- Feeling and thinking: François is unhappy, thinking, “I need to talk with the Pension Centre again!”

- Opportunities: None.

6. Define the problem

The problem

With these user insights in hand, we organized a define workshop and collaborated with the Pension team to create a problem statement from the user’s perspective:

7. Ideate and prototype solutions

Ideate and prototype

Now that we understood the problem and our users’ needs and challenges, we moved to the design phase and kept it agile. We collaborated and developed new ideas and prototypes for a pension portal experience that would meet user and business needs and would be technically feasible.

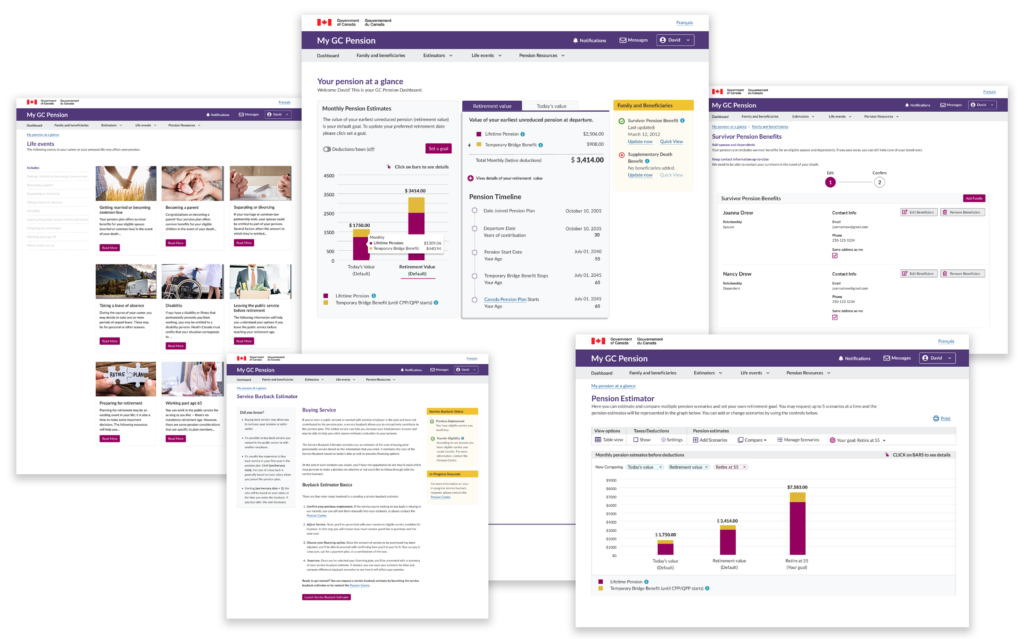

Long Description: The prototypes

The team created 5 screen shots, capturing the interface and functionality of the new Pension Portal. These shots include:

- Your Pension at a Glance: a personalized dashboard with graphics featuring a chart with monthly pension estimates, retirement value, pension timelines and family and beneficiaries.

- Life events that could affect pension: getting married, getting divorced, having a child, becoming disabled, working past 65, taking early retirement, etc., with links to more information.

- Service buyback estimator: an easy-to-use calculator to determine the cost of retroactively contributing to your pension plan.

- Survivor Pension Benefits: an easy-to-use interface to add or remove your pension beneficiaries.

- Pension estimator: estimate and compare multiple pension scenarios to help you set retirement goals. The results are presented in colourful and easy-to-understand charts.

8. Test with users, iterate and test again

Test and Iterate

We involved our users, and accessibility experts, every step of the way. We tested new prototypes with them, iterated based on their feedback and tested again.

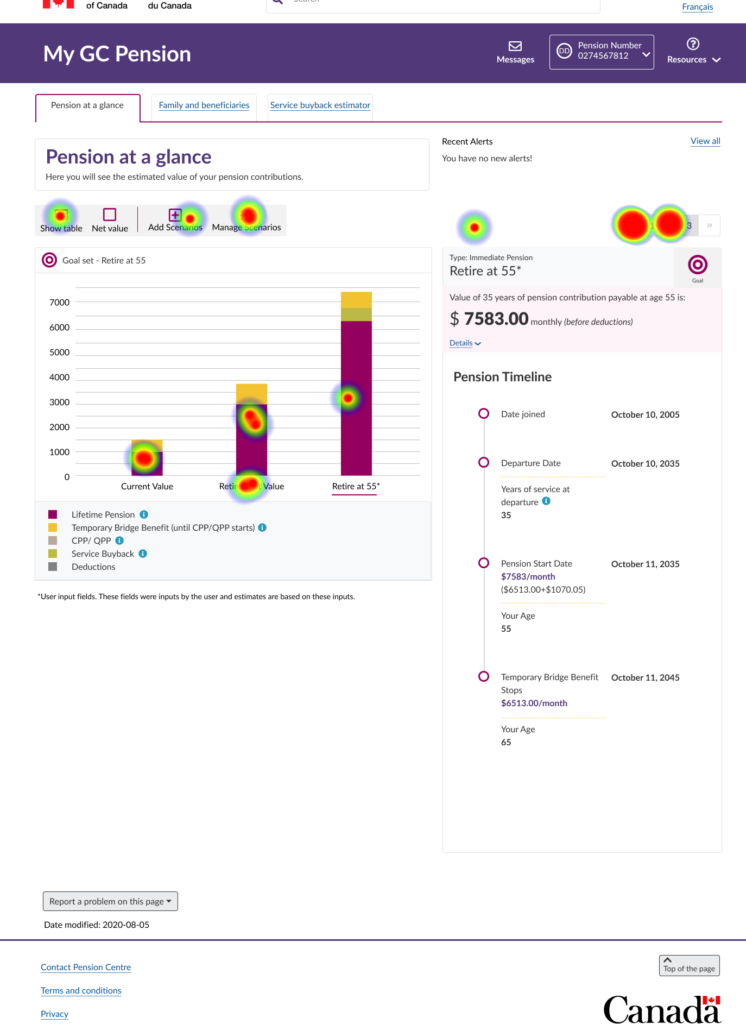

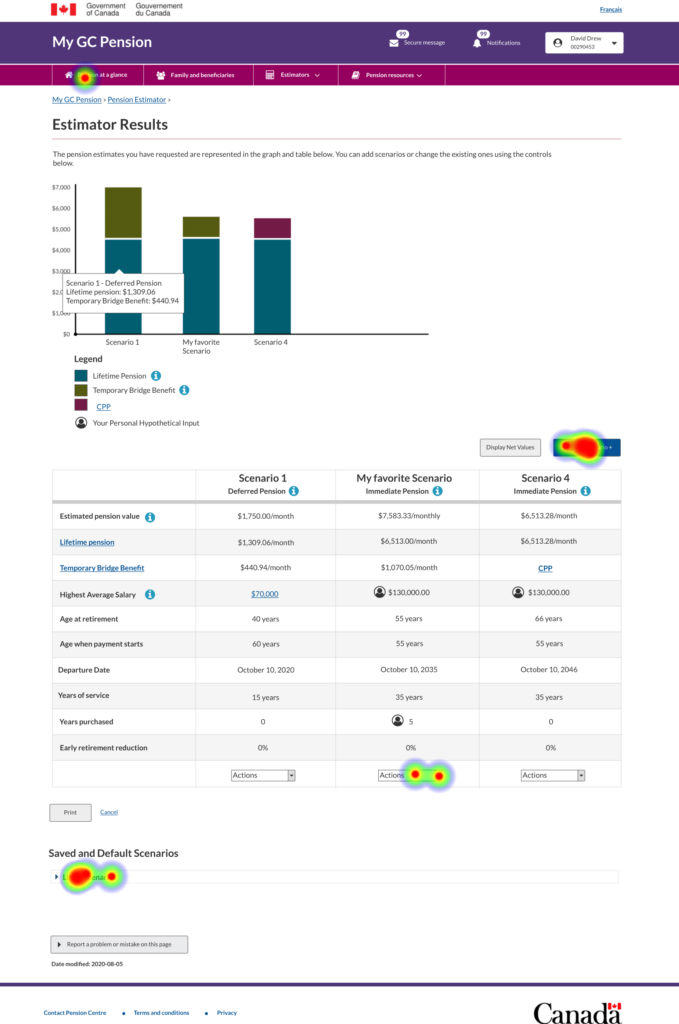

Heatmaps capturing where users click

During usability testing we collected different types of data. The heatmaps below captured where users clicked the most with red being the most popular (hot) and blue the least popular (cold).

Our latest prototype provides a highly personalized experience for users. The system recognizes who they are when they log in and brings up their key information in an interface that is intuitive, uses plain language and is easy to use. It will go a long way in meeting employees’ needs and helping them make important life decisions about their pensions and retirement.

The Pension team is ready to take this prototype to the next level. This means working with their vendor to evaluate its feasibility and the ultimate design of the final product. Stay tuned!